Ugazf Stock: VelocityShares 3x Long Natural Gas ETN (UGAZF) is a passively managed Miscellaneous Trading–Leveraged Commodities exchange-traded fund (ETF). Credit Suisse AG launched the ETF in 2012.

The investment seeks to replicate, net of expenses, three times the performance of the S&P GSCI Natural Gas Index ER. The index comprises futures contracts on a single commodity and is calculated according to the methodology of the S&P GSCI Index.

High portfolio turnover can translate to higher expenses and lower aftertax returns. VelocityShares 3x Long Natural Gas ETN has a portfolio turnover rate of 0%, which indicates that it holds its assets around 0.0 years. By way of comparison, the average portfolio turnover is 0% for the Trading–Leveraged Commodities category.

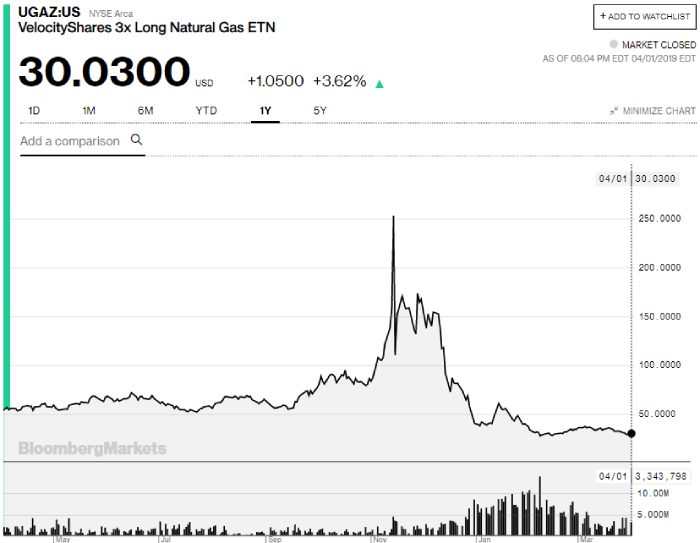

Recently, in the month of December 2022, VelocityShares 3x Long Natural Gas ETN returned -77.4%, which earned it a grade of F, as the Trading–Leveraged Commodities category had an average return of -5.7%.

The letter grades of A, B, C, D and F are based upon relative rankings within the investment category. A grade of A, for example, would indicate that the return is in the highest 20% for that time period compared to all ETFs in that category.

Table of Contents

Is Ugaz Still Trading?

The triple leveraged inverse natural gas ETN has gone off the rails and transitioned from risky to downright dangerous.

If you’ve ever traded in leveraged ETFs or ETNs, you know they can be wildly volatile. If you’ve ever dabbled in leveraged inverse products that are thinly traded in the OTC market, you’re taking it to a whole new level.

And then there’s the case of the VelocityShares Daily 3x Inverse Natural Gas ETN (DGAZF).

As little as a few days ago, it traded at $400 a share. A week later, it was at more than $24,000. Today, it’s back down to a “modest” $13,000.

So, how does a delisted triple-leveraged inverse natural gas exchange-traded note (yes, that’s a lot to say) increase 60-fold over the matter of a week? The short answer is we don’t know for sure, but we have some ideas. There’s a lot to unpack here, so let’s take it step by step.

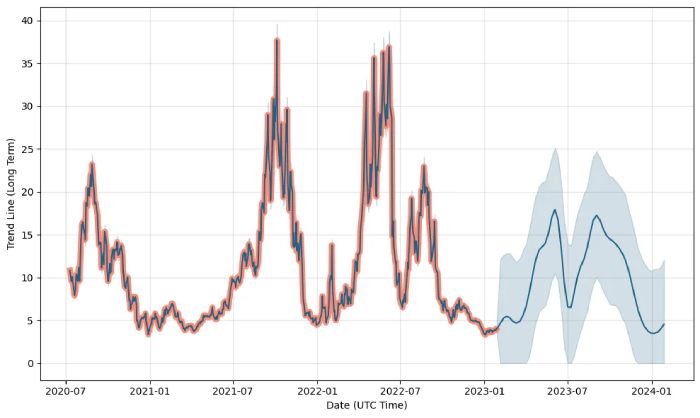

Ugazf Stock Forecast

A buy signal was issued from a pivot bottom point on Friday, December 30, 2022, and so far it has risen 29.22%. Further rise is indicated until a new top pivot has been found. Furthermore, there is a buy signal from the 3 month Moving Average Convergence Divergence (MACD). Some negative signals were issued as well, and these may have some influence on the near short-term development.

The VelocityShares 3x Long Natural Gas ETN stock holds a buy signal from the short-term moving average; at the same time, however, the long-term average holds a general sell signal. Since the longterm average is above the short-term average there is a general sell signal in the stock giving a more negative forecast for the stock. On further gains, the stock will meet resistance from the long-term moving average at $4.11.

On a fall, the stock will find some support from the short-term average at $3.86. A break-up through the long-term average will give another buy signal, while a fall below the short-term average will add another sell signal and strengthen the general signal. Volume fell during the last trading day while the price increased. This causes a divergence and may be considered as an early warning, but it may not be. The very low volume increases the risk and reduces the other technical signals issued.

Ugaz Stock Price Today

For the upcoming trading day on Monday, 30th we expect VelocityShares 3x Long Natural Gas ETN Linked to the S&P GSCI Natural Gas Index ER to open at $3.93, and during the day (based on 14 day Average True Range), to move between $3.62 and $4.34, which gives a possible trading interval of +/-$0.358 (+/-8.99%) up or down from last closing price.

If VelocityShares 3x Long Natural Gas ETN Linked to the S&P GSCI Natural Gas Index ER takes out the full calculated possible swing range there will be an estimated 17.97% move between the lowest and the highest trading price during the day.

Since the stock is closer to the support from accumulated volume at $3.90 (2.01%) than the resistance at $4.38 (10.05%), our systems sees the trading risk/reward intra-day as attractive and believe profit can be made before the stock reaches first resistance.

Ugazf Stock Predictions

- Is VelocityShares 3x Long Natural Gas ETN stock public?

Yes, VelocityShares 3x Long Natural Gas ETN is a publicly traded company. - What is the VelocityShares 3x Long Natural Gas ETN stock quote today?

The VelocityShares 3x Long Natural Gas ETN stock price is 3.98 USD today. - How to buy VelocityShares 3x Long Natural Gas ETN stock online?

You can buy VelocityShares 3x Long Natural Gas ETN shares by opening an account at a top tier brokerage firm, such as TD Ameritrade or tastyworks.

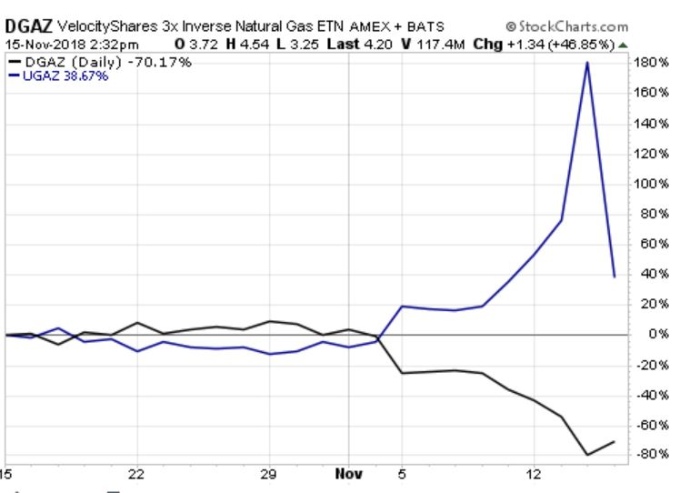

What Is The Difference Between Ugaz And Dgaz?

UGAZ and DGAZ are two 3x leveraged EFTs that track the same underlying asset — the United States Natural Gas Fund. Now, the UNG tracks the price movements in natural gas. So a UNG stock prediction will impact DGAZ and UGAZ directly.

The primary objective of UGAZ (VelocityShares 3x Long Natural Gas) is to amplify the daily performance of UNG by three times or 200%. In other words, if UNG price raises 1%, UGAZ will generally show a daily gain of 3%. You should think about trading UGAZ when you have a bullish sentiment on UNG.

The primary target of DGAZ (VelocityShares 3x Inverse Natural Gas) is to generate profits from the losses in the UNG fund. DGAZ will tend to amplify the losses by three times or 200% inversely. Thus, if UNG price falls by 1%, DGAZ should bring you a profit of 3%. Accordingly, you would consider this leveraged ETF when you have a bearish sentiment on the UNG fund.

As you may have noticed, both UGAZ and DGAZ have 3:1 leverage, which can significantly increase your potential profit.

How To Create A Stock Ticker

As anyone who has ever watched a financial network or checked out a market web site knows, security prices, particularly those of stocks, are frequently on the move. A stock ticker is a report of the price of certain securities. Updated continuously throughout the trading session by the various stock market exchanges.

A “tick” is any change in the price of the security, whether that movement is up or down. A stock ticker automatically displays these ticks, along with other relevant information, like trading volume. That investors and traders use to stay informed about current market conditions and the interest in that particular security.

Conclusion

Get Credit Suisse VelocityShares 3x Long Natural Gas (UGAZF:OTCPK) real-time stock quotes, news, price and financial information from CNBC.

The index represents the commodity markets. It seeks to track long positions and comprises of derivatives such as futures contracts to represent natural gas.